Ethiopia: Crop insurance

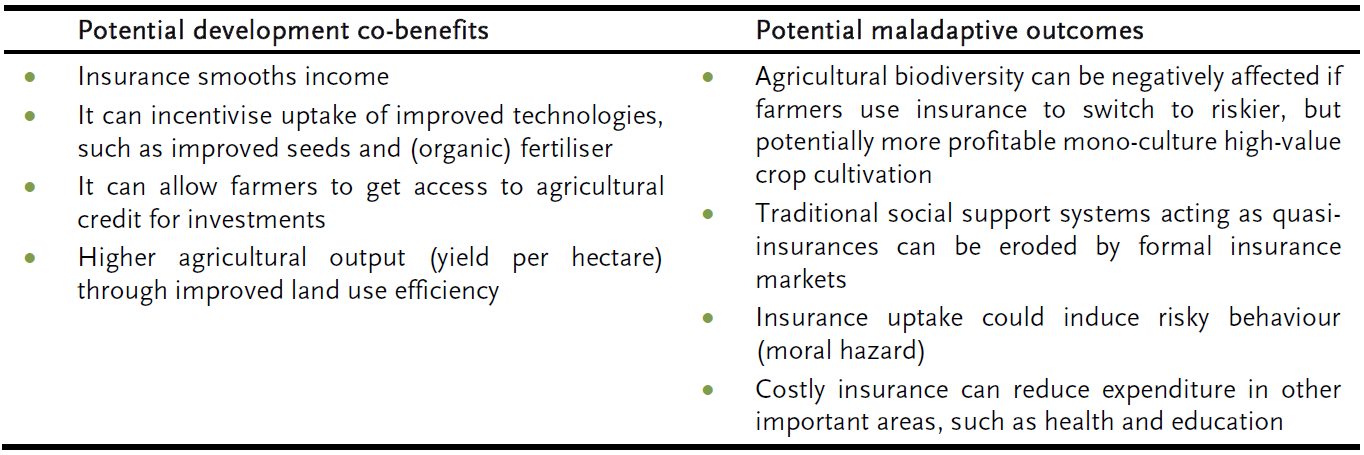

While most adaptation strategies seek to minimise risks stemming from climate change, not all risks can be eliminated. Weather perils, such as droughts, storms or erratic precipitation represent so-called systemic risks that go beyond the farmers’ or communities’ coping ability. Thus, mechanisms are needed that distribute risk to avoid that certain groups or individuals are particularly affected and lose their livelihoods. One of such risk transfer solutions is crop insurance, which allows farmers to insure their crop yields against weather-induced losses. It is also a risk-specific adaptation strategy, which becomes irrelevant in the absence of weather and climate risks. While insurance usually is based on indemnity-assessment, with smallholder farmers this model is problematic due to the high transaction costs such an insurance scheme entails, e.g. for claim disbursements. Thus, a more suitable approach for smallholder farmers are weather index-based insurances (WII), a scheme that uses a weather index, such as temperature or precipitation to determine a payout. Alternative index-based insurance schemes can also be useful, such as area-yield index insurance.

Index insurance schemes for crops and livestock have been developed and tested in several pilot schemes in Ethiopia, but are not widely implemented yet. There is continued interest and engagement from within the country to further promote insurance solutions for the agricultural sector. For example, the Japan International Agency for Cooperation (JICA) recently launched a new “Index-based Crop Insurance Promotion (ICIP) project” in 2019 together with the Ministry of Agriculture and the Oromia Bureau of Agriculture and Natural Resources (OBoANR) (JICA, 2019). The programme is expected to cover 20,000 farmers in the Oromia region over the next five years.

During expert and stakeholder interviews conducted for this study, there was wide consensus that crop and livestock insurance has a low uptake in Ethiopia as of yet, and is regarded as having only limited upscaling potential in the country. Accordingly, interest in insurance among interviewees, survey and workshop participants was low, which may, however, be rather an expression of difficult implementation of insurance schemes than of general lack of interest, as the in-depth interviews revealed. Thus, there appears to be a need for further research on how to effectively operationalise insurance in Ethiopia and how to ensure better uptake and sustainability.

In sum, crop insurance can be considered an important adaptation strategy, because it can address risk, which cannot be mitigated in an economically sensible way with physical adaptation measures and acts as a safety net for farmers in times of extreme weather events. However, premium costs may not be affordable for farmers, requiring financial support in order to increase uptake.

References

- Japan International Cooperation Agency (JICA). (2019). Index-based Insurance to benefit Small-holder Farmers through JICA Project. Retrieved June 13, 2019, from https://www.jica.go.jp/ ethiopia/english/office/topics/190419.html.