Many options exist for farmers in Ghana to adapt to climate change. In the climate risk analysis for Ghana conducted within the Agrica project, five promising adaptation strategies were analysed in detail: crop insurance, post-harvest management, irrigation, rainwater harvesting and improved crop varieties. Those strategies were selected based on stakeholder interest, links to existing climate change adaptation plans in Ghana and suitability for analysis within crop models. Yet, they only present a small subset of possible and suitable adaptation strategies, in addition to them, many different adaptation strategies can be useful and the local context and communities’ needs are key for ultimately deciding on the strategies to pursue. The strategies portrayed are thus meant as indications only, for which adaptation measures may provide a useful start and hold potential at a wider scale.

Post-harvest management can be recommended for wider implementation across Ghana, as the analysis shows high potential for upscaling and attainment of adaptation goals. Crop insurance is particularly well-suited for upscaling and, as a risk-transfer strategy, crucial for complementing risk-reduction measures, which equally can be recommended for uptake in the whole of Ghana. Rainwater harvesting is a low-cost strategy with potential for autonomous uptake and additional agricultural production. Both improved crop varieties and irrigation are rather costly strategies, requiring much institutional support. Their implementation feasibility and suitability varies according to location in Ghana, irrigation is generally only recommended for areas suffering from insufficient or highly variable precipitation levels but can offer improved agricultural production levels in dry areas, if other water use interests can be reconciled with water demand for irrigation. Improved crop varieties are judged to have better prospects for transforming agriculture, also given the mostly sufficient precipitation levels in Ghana. However, improved seeds always need to cater to the requirements of local agro-ecologies, thus they cannot be recommended for the whole of Ghana. Employing multiple adaptation strategies can be useful, especially the combination of risk-reducing and risk-transferring strategies is promising. Risk-reduction measures like irrigation and improved crop varieties are important for addressing risk that can be mitigated, whereas risk-transfer strategies such as insurance are needed for managing risk that cannot be reduced.

This evaluation is only to be viewed as a careful model-based and expert assessment, which can by no means replace a thorough analysis for specific project design and local implementation planning. It gives an indication of the overall feasibility and suitability of the selected adaptation strategies in Ghana. Actual selection of adaptation strategies, however, should always be based on specific needs and interests of local communities.

Crop insurance

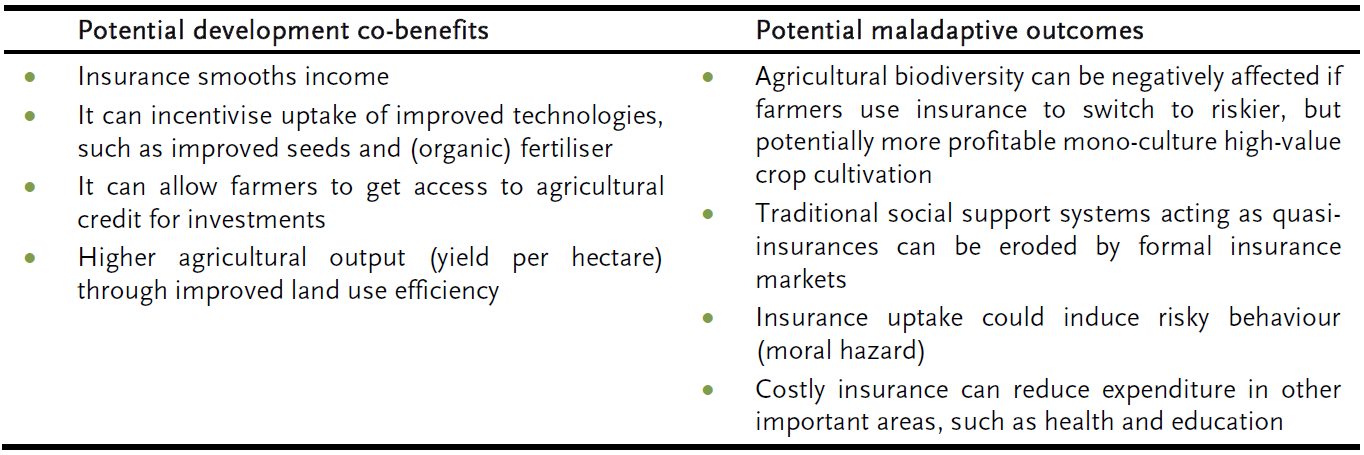

While most adaptation strategies seek to minimize risks stemming from climate change, not all risks can be eliminated. Weather perils such as droughts, storms or erratic precipitation represent so-called systemic risks that go beyond the farmers’ coping ability. Thus, mechanisms are needed that distribute residual risks to avoid that certain groups or individuals lose their livelihoods. One such risk transfer solution is crop insurance, which allows farmers to insure their crop yields against weather-induced losses. While insurance usually is based on indemnity assessment, this model is problematic for smallholder farmers due to the high transaction costs which insurance schemes usually entail. Thus, a more suitable approach for smallholder farmers are weather index-based insurances (WII), a scheme that uses a weather index, such as precipitation, to determine a payout. Alternative index-based insurance schemes can also be useful, such as area-yield index insurance.

Generally, insurance schemes are rather costly adaptation strategies, at least when considering the overall costs and with progressing climate change increasing the overall risk to the agricultural sector. However, insurance schemes have an important role to play for securing livelihoods: They can stabilize farm incomes and can prove to be very cost-effective for farmers when a hazard occurs.

According to the Ghana Agricultural Insurance Pool (GAIP), area-yield index insurance (AYII) as an alternative to WII has shown the biggest potential for smallholder farmers in Ghana as of yet. GAIP is a pioneer in implementing AYII in Ghana, insuring since 2011 successfully some 3000 – 4000 smallholder farmers’ cereal crops[1] on over 18,000 acres of land. In 2017, GAIP made payouts to nearly half its insured parties.

Although AYII is a promising development, farmers’ uptake of AYII in Ghana remains limited. Balmalssaka et al. (2016), who examined the willingness of farmers in northern Ghana to participate in insurance schemes, found access to credit as well as education and experience with insurance to be important factors determining farmers’ engagement with crop insurance (Balmalssaka et al., 2016).

This indicates the need for additional incentives or financial support for taking out insurance, underlined also by Aidoo et al. (2014) who determined farmers’ willingness to pay for crop insurance in one municipality in Ghana. He concluded there was a need for government subsidies to implement it in the country (Aidoo et al., 2014). While subsidies are one strategy, experts also suggested to bundle insurance with inputs, where possible, to increase uptake.

Overall, crop insurance is a promising strategy for transferring climate risk also in Ghana. There is high interest in Ghana and demand-based roll-out of insurance pilots can be recommended. However, careful design is crucial to ensure affordability and financial sustainability.

Post-harvest management

Effective post-harvest management is crucial to avoid food loss along the value chain. Investments in scaling technologies for improved post-harvest management have high potential for reducing crop losses, also and especially under climate change. With climate change altering growing and harvesting seasons, post-harvest management is important to cope with increased uncertainty. It is a risk-reducing strategy that lowers the vulnerability of crop production to climate impacts. Next to main staple crops such as maize and beans, post-harvest loss (PHL) of easily perishable horticulture crops could be avoided. Numerous effective and low-cost technologies exist that can prevent or reduce PHL.

Ghana’s NDC Implementation and Investment plan lists post-harvest management as a priority for adapting agriculture to climate change, with interviews confirming wide-spread interest in such strategies. A concrete post-harvest technology with promising results in the context of maize production in Ghana have been so-called PICS bags (Purdue Improved Cowpea Storage): simple and affordable yet effective hermetic storage bags originally developed for storing cowpea. Implementation of improved post-harvest management strategies can be recommended across the country as a low-hanging fruit, since better post-harvest management can increase agricultural production considerably.

Furthermore, as the economic analysis confirmed, most post-harvest management measures are rather low cost interventions, with most intervention types being “no regret” strategies because even in the absence of climate change, the improvement in crop handling will lead to lower crop losses and higher agricultural output, being economically sensible. Figure XX shows the net value of maize production under different post-harvest management scenarios, compared to scenarios of maize production without adaptation – both with (CC) and without climate change (BAS). Except for the highest cost scenario (MAX), all other PHM scenarios do not only make up for the maize losses under climate change, but are also able to surpass maize production under the baseline scenario (without climate change and without adaptation). This shows their high economic viability.

[1] The main insured crops are: maize, sorghum, millet and groundnut.